Written by Yikun Shao, Alibaba.com North America B2B Customs and Trade Compliance Lead

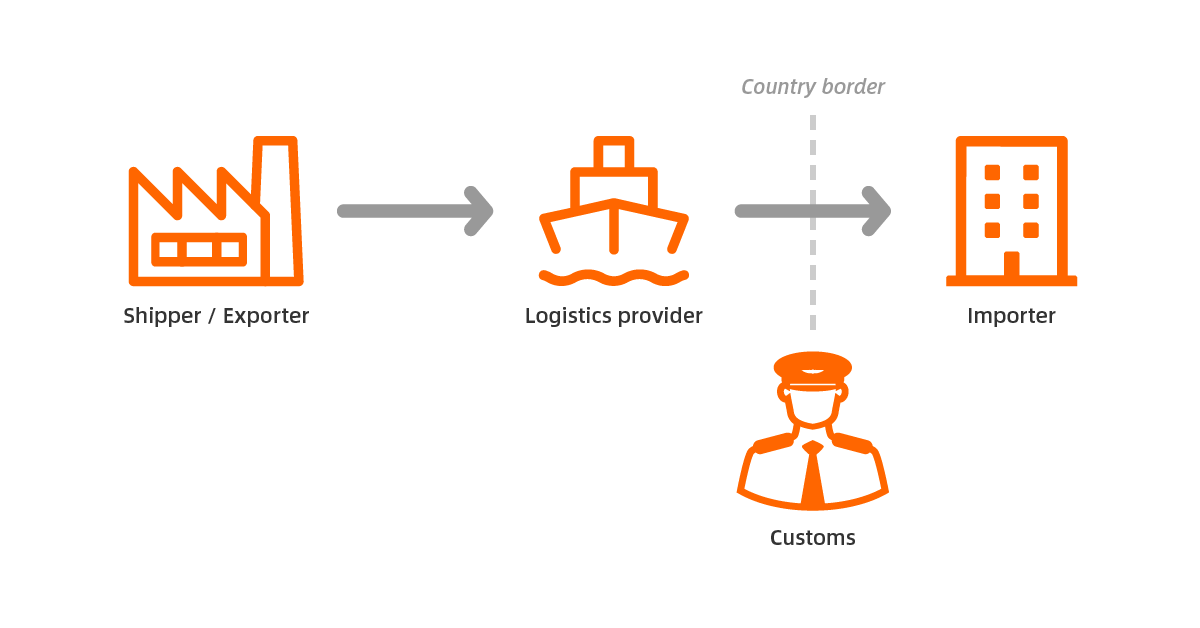

Navigating the ins and outs of cross-border trade can be a complex undertaking. One of the key elements in understanding this process means being familiar with country specific import/export rules and regulations enforced by the Customs agency. Their responsibilities range from preventing illegal trade practices and assessing Customs duties and taxes to collecting accurate import/export data and protecting border security.

While small and medium-sized businesses tend to rely on third-party service providers such as a customs broker to declare goods upon importation, understanding the fundamental framework and implications of Customs affairs goes a long way. Not only will it help ensure timely delivery and reduce non-compliance risks (and associated liabilities), but you’ll be able to make more informed sourcing and business decisions. Let’s start with the basics.

Customs duties and tariffs serve the broad purpose of raising government revenue, protecting domestic industries, and influencing trade policy. They are imposed on products being imported from one country to another, and result in a higher landed cost that can sometimes erode margins or diminish competitive advantage when passed along in customer pricing. Therefore, it’s very important for small and medium-sized businesses to understand what tariffs will cost them before entering into a transaction.

Tariffs and duties are typically always incurred by the importer which, in most situations, would be the buyer in an import transaction. For that matter, the buyer is also responsible for import Customs clearance under most trade terms. While you or your freight forwarder will probably enlist the help of a customs broker to clear goods through Customs and settle tariff payments, bear in mind that you, the importer, are the legally responsible party.

The next thing is to understand the amount of tariffs due. This is unfortunately easier said than done. Tariffs are usually bundled within the landed cost and are not “finalized” until all entry information is reviewed by Customs. You can think of an import entry as a “mini tax return,” filed in each instance of importation instead of periodically.

Therefore, providing accurate information to Customs is not only a compliance obligation, but it can affect the duty/tariff amount you are liable for. Let’s take a closer look next.

There are numerous data elements an importer is required to provide on an import entry. Among them, some key items (also those that are more likely to create an issue) are:

| Tariff classification | What is the product being imported? |

| Customs value | What is the value of the items in your shipment? |

| Country of origin | Which country is considered the origin of the imported product? |

| Admissibility | Is the product being imported admissible under Customs and other laws/regulations? |

| Quantity | Does the quantity declared to Customs match those actually shipped? |

| Recordkeeping | Are you satisfying Customs' recordkeeping requirements? |

The first three items, tariff classification (more widely known as product “HS” or “HTS” codes), Customs value, and country of origin, are the three factors determining Customs duty/tariff amounts. As a general rule, Customs value forms the basis, and tariff classification determines the rate, to calculate the duties and tariffs.

With this in mind, it’s not difficult to understand why ensuring the accuracy of information you submit is not just a requirement but also in your best interest. A single misclassification could have a great impact on the Customs cost you bear. While you can (and should) rely on a customs broker to help you prepare your import entries, the core information used to determine the appropriate classification and the like can only come from the business — either you or your supplier.

To make matters even more complicated, just because your import entry clears Customs does not mean your liability stops there. In fact, Customs authorities around the globe have been moving their focus of enforcement activities from the point of entry to post-import audits so cross-border trade can be more efficient.

In the US, the statute of limitation for Customs purposes is generally five years from the date of entry. Within that period, Customs can impose penalties in addition to collecting any underpaid or unpaid tariffs. This is yet another reason why retaining import documentation and revising any incorrect information previously declared is important.

This week's #B2BTuesday Tip:

Providing correct information for your imports is your legal responsibility as the importer, and prevents you from incurring inaccurate duty/tariff costs.